There comes a time, in every business owner’s routine, that the question must be asked, “What have I learned from my experience?” For some, the answer is about sales and how to better appeal to potential customers. For others, it’s operational and focused on making their business bigger and better in the years to come. In the speaking industry, both of these areas must be considered each year, and 2022 is no exception.

With that in mind, every year, the SpeakerFlow team conducts their “State of the Speaking Industry” report in which we ask speakers a series of questions about how they managed their businesses throughout the previous year. This includes sales, marketing, and operational questions. However, it also includes open-ended questions such as “What are some of the challenges you faced in the previous year?” and “How have you adapted to address said challenges?”

In short, the goal of our annual report is not simply to share data. It’s also to outline ways you can turn that data into action in the upcoming year. That way, you can learn from others’ experiences as well as your own, track industry changes, and make next year the best one yet.

So, without further ado, below is a quick snapshot of the findings from SpeakerFlow’s 2022 State of the Speaking Industry Report. If you’d like to learn more about our reporting process or, if you’d like technology to help you make the most of these findings, book a call with us! Whether you’re a new speaker or an experienced one, we’re here to help. 👍

Download the Latest Report 👇

We collected insights, trends, and research from thought leaders in every stage of the business.

Here’s what we learned from their experiences in 2022.

Speaking Industry Stats Overview

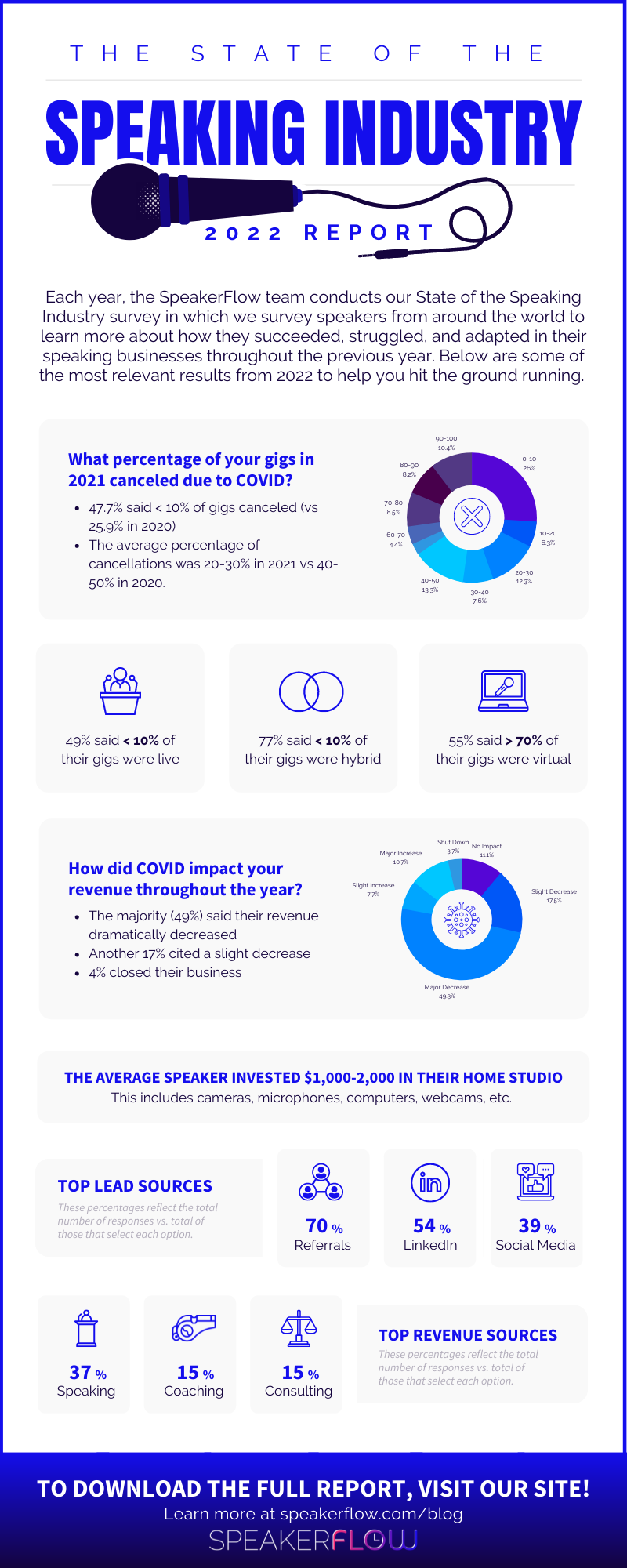

First and foremost, let’s talk about the speaking industry in a general sense. Overall, 2021 was an optimistic year for the speaking industry in which speaking businesses saw a small upswing from the COVID-19 pandemic and experienced speakers continued to rebuild. Of those surveyed, the average participant had between 9-12 years of professional speaking experience. They also considered themselves to have been running a speaking business for about 10 years. This makes the 2022 report especially applicable for readers in the early but established stages of their business, still focused on growth.

More importantly, though, the percentage of speakers building teams saw a significant increase. Compared to 70% in 2020, 67% of survey participants in 2021 indicated that they were solopreneurs (i.e. did not have a team). Additionally, in the last year, the number of respondents that said they have one team member (excluding themselves) has doubled, the average team has risen from two to three members, and more than 10% of participants had teams of 10 or more.

All of these changes indicate that, as speakers rebound, they’re investing that success back into their businesses. It also suggests a shift away from the common mindset that “You must learn to do it all yourself”. In other words, an increasing number of speakers are outsourcing aspects of their business they don’t absolutely need to manage. In our experience – and as any million-dollar speaker will tell you – this practice produces a substantial ROI, both monetarily and in professional happiness.

Takeaways:

- Despite the COVID-19 pandemic, the majority of speakers have remained optimistic. In fact, when asked about their confidence in running a speaking business, more than half of participants gave themselves a 7 or higher out of 10. The average was 8.5/10, up from 7.5/10 in 2020!

- The greatest gain in confidence has been in relation to sales. When asked which area of their business is the greatest source of anxiety – sales, marketing, or operations – 41% of participants chose sales, compared to more than 50% in 2020. This drop again demonstrates the ability of speakers to bounce black despite the pandemic’s challenges.

- The greatest loss in confidence has been in marketing. When asked about their confidence in marketing a speaking business, the average participant rated themself a 4.5/10. This is a fall of 1 point from 2020.

Speaker Sales Stats Overview

After an industry overview, the next segment of the 2022 Report focused on revenue in the speaking industry. This included common sales practices, challenges, and lead and revenue sources. For the most part, all of these areas in 2021 were similar to those in 2020 with an emphasis on virtual products and services such as virtual speaking programs, workshops, and digital coursework. The most common sources of new leads were referrals, LinkedIn, and social media (Facebook, Twitter, Instagram, etc.). The most common sources of new business – products/services leads purchased – were speaking, coaching, and consulting.

Compared to 2020, the biggest changes to speakers’ revenue streams in 2021 were 8% increases in both speaking and consulting. There was also an increase in reliance on all revenue streams listed (which can be found on page 9 of the full report PDF), suggesting that a rising number of speaking business owners are diversifying their sales offerings beyond standard speaking programs.

That said, despite this apparent expansion and the increased sales confidence participants reported, the majority of those surveyed spend less than 20% of their time each week looking for new leads with the most common response being “10% or less. “ Furthermore, 53% of respondents said they are not using a customer relationship management system (CRM) to manage the leads they do have (up from 46% in 2020). Together, these actions are proven to prevent predictable revenue growth, year over year. We’ll talk more about these effects in the next section and how speaker revenue fared between 2020 and 2021.

Takeaways:

- Self-generated revenue remains a challenge for professional speakers. The percentage of speakers that rely on referrals for the majority of new business has, in fact, risen dramatically in the last year alone from 52% in 2020 to 65% in 2021.

- Technology continues to be a source of debate throughout the industry, especially where CRMs are concerned. In conjunction with the aforementioned reliance on referrals, this is consistent with the average speaker’s sales-related anxiety in their business.

- An increasing number of speakers are branching into digital sales offerings. Both online coursework and membership sites saw a 2% increase in the percentage of speakers relying on them for revenue.

- Despite the revenue potential in existing relationships, upselling and cross-selling are still relatively untapped sales strategies. In 2021’s report, on average, participants attributed only 30-40% of their revenue to repeat clients.

Comparing The 2021 and 2022 Reports’ Stats

Now that we’ve covered sales in the context of 2021, how do those stats compare with the previous year? Generally, 2021’s sales stats were similar to those of 2020 with slight improvements. In terms of speaking gigs booked, the average speaker delivered 5-10 paid gigs in both 2020 and 2021. However, the percentage of speakers delivering free gigs dropped with only 17% of participants delivering more than 10 free gigs in 2021 versus 28% in 2020. This, again, illustrates the shift away from free gigs – which many speakers settled for in 2020 – and towards self-advocation and higher speaking fees.

Speaking of fees (no pun intended), 2020 and 2021 sales stats were also similar where revenue was concerned. Of those surveyed in 2021, the majority (65%) charged less than $5,000 per gig (down from 70% in 2020). On the other end of the spectrum, the percentage of speakers charging between $10,000 and $20,000 also increased from 5% in 2020 to 8% in 2021. Like the shift away from free gigs, this shows a similar trend of charging more per paid gig. Put simply, as speakers recover, they’re not only arguing for compensation but also that said compensation is higher than in previous years.

Lastly, when it came to income, the mean and median annual revenue remained the same between 2020 and 2021 at $50-75,000. This consistency mirrored other trends from the last several years, such as increases in speakers making less than $50,000 annually (up 14% from 2020) and more than $500,000 annually (up 1.3% from 2020).

Takeaways:

- In many ways, sales are returning to pre-COVID numbers with fewer speakers accepting free gigs, simply for the exposure. In fact, more than 62% of those surveyed delivered less than five free gigs in 2021. This is a massive increase from 2020’s 51% and further supports the assertion that speakers are regaining their sales confidence and ability to increase speaking fees.

- Although the industry is recovering, the average income of professional speakers remains unchanged. Where the average speaker reported between $75-100k in 2019, 2020 and 2021’s average speaker reported between $50-75K.

- The “wealth gap” (for lack of a better term) among speakers is rising with an increasing percentage of speakers making less than $50K or more than $1 million annually, the former from 43% to 57% and the latter from 1.3 to 2.7%. This is consistent with the growing competitiveness of the industry.

The Continued Effects Of COVID-19 On The Speaking Industry

Finally, we’d be remiss if we didn’t address the ongoing effects of the pandemic on the speaking industry. In last year’s 2021 report, most of the COVID-related findings were bleak. More than 80% of participants had made drastic changes in order to pivot to virtual speaking, and a small percentage had even closed their businesses completely. Of those that stayed afloat, many were hard-pressed to stay motivated. Many said something along the lines of, “I’m working harder to make the same amount of money” or “I had no non-speaking revenue streams, and I’m struggling to adapt.”

Conversely, although the pandemic’s not over yet, the COVID-related results of this year’s report were largely positive. In terms of cancellations, almost half of participants (48%) said less than 10% of their gigs were canceled, up from 26% of participants in 2020. Similarly, the percentage of rescheduled gigs (30%) stayed consistent for the average speaker.

Numbers aside, many participants’ replies to open-ended questions were also noticeably more upbeat. For example, in response to the question, “How have your revenue streams shifted in response to COVID?” some of the most common responses were, “I’m building additional revenue streams to make up for less speaking” and “I’m doing more gigs each week since they can all be virtual and travel-free.”

It’s also important to note that virtual speaking isn’t going away. Even this year, the majority of survey respondents said more than 70% of their 2021 gigs were completely virtua. From 2020, this is an increase of more than 20%.

Takeaways:

- The effects of the pandemic are far from over. The majority of survey respondents (49%) blamed it for dramatic decreases – and continuing challenges – in revenue between 2019 and 2021.

- Event organizers weren’t immune to the effects of the pandemic on the speaking industry. However, those effects seem to be reversing for them as well with the average speaker saying only 20-30% of their 2021 gigs were forced to cancel due to COVID, compared to 40-50% in 2020.

- Diversification is becoming a vital part of successful speaking businesses. In both 2020 and 2021, participants cited it as a primary reason for their business’s survival.

- Virtual products and services are becoming a greater source of revenue. Over half of 2021’s survey participants mentioned them as either active offerings or planned offerings for the upcoming year. Many participants also mentioned only having offered them, initially, because of COVID-related restrictions.

How To Use This Information To Thrive In 2022

Summarily, the results of 2022’s State of the Speaking Industry Report suggest a sort of plateau. Unlike 2020, which was largely about survival, 2021 signifies a turning point towards resurgence, and returning to pre-pandemic speaking industry practices, albeit with an accelerated preference for virtual speaking and digital products/services.

Hopefully, by breaking down some of the key findings from our 2022 State of the Speaking Industry Report, you can tackle these changes and begin 2022 with clarity and a clear sense of purpose for change in your speaking business. For more information – and a checklist of recommended next steps – download the full PDF.

Note from the SpeakerFlow team: For this report, we surveyed a limited pool of a large, growing, and complex industry. Consequently, we are aware that this data is a small screenshot of the big picture. We want to make it clear that every stat in this report is simply a tool to understand where our industry is going. For the best possible information, we recommend combining these insights with those of other organizations in the industry such as Meeting Professionals International (MPI), the International Association of Speakers Bureaus (IASB), the Global Speakers Federation (GSB), and your local speakers associations.

Download the Latest Report 👇

We collected insights, trends, and research from thought leaders in every stage of the business.

Here’s what we learned from their experiences in 2022.